Understanding Surcharging, Cash Discounting & Dual Pricing: Visa Compliance Guide for 2025

by Dustin Magaziner, CEO and Founder of PayBright

What Business Owners (and Agents) Need to Know About the Future of Differential Pricing

Business owners are tired of paying fees, Agents are confused about the rules surrounding the programs, and consumers are seeing more and more ‘fees’ for using cards. Credit card companies continue to stack on new perks for cardholders — from free DoorDash and Uber rides to travel rewards, cash back, rental car insurance, and so much more. And while these benefits are great for consumers, they’re being funded by one group: the businesses who accept those cards.

Because of these rising costs, it’s no surprise that more and more business owners are searching for ways to offset, or even eliminate, their processing fees altogether. In fact, over the past five years, differential-pricing programs have exploded in popularity — with some reports estimating that 34% businesses now pass on at least a portion of processing costs to customers. Many merchants are now comparing cash discount vs surcharge vs dual pricing programs to find the right fit

Today, there are three core methods used to reduce or eliminate credit card fees:

Surcharging

Cash Discounting

Dual Pricing

While these terms often get used interchangeably, they’re very different under Visa’s rules — and mixing them up can quickly turn a compliant program into a costly violation. Let’s break them down.

1. Surcharging

Surcharging is a fee-based program — meaning a business adds a fee when a card is used.

Under Visa’s definition:

A surcharge is any fee added to a card payment that is not also applied to all other forms of payment.

That definition matters. It means that if a fee appears only on card transactions — even if the business calls it a “non-cash adjustment,” “service fee,” or “technology cost” — it’s a surcharge, and Visa’s surcharge rules apply.

Importantly, Visa also considers any price increase at the register tied to card use — even if it isn’t listed as a separate line item — to be a surcharge. In other words, if the price a customer pays for an item is higher when using a card than it would be with cash, that is a surcharge under Visa’s rules, regardless of what the merchant calls it or how it appears on the receipt.

Visa’s Surcharge Rules at a Glance

Credit cards only. Debit and prepaid cards can never be surcharged — even if they’re “run as credit.”

Surcharge Cap: limited to the lower of 3 % or the merchant’s actual cost of acceptance.

Registration & reporting: the merchant must notify its processor or acquirer at least 30 days before launching a surcharge program, and the surcharge must be properly passed through Field 28 of the transaction record (and appear on the customer’s receipt).

Signage: required at both the point of entry and the point of sale, clearly stating that a surcharge applies to credit card purchases.

Prohibited states: Connecticut, Maine, and Massachusetts.

New York: permits differential pricing under its Transparent Pricing Law (NY Gen. Bus. Law § 518-a) but requires that the card price be disclosed before payment. Non-transparent pricing can result in fines of up to $500 per transaction.

Oklahoma: As of November 1, 2025, Oklahoma allows surcharging with a maximum rate of 2%, or the merchant’s cost of acceptance, whichever is less.

Visa’s stance is consistent and clear — the cardholder must know the full price before choosing how to pay. Compliance isn’t just a legal safeguard; it’s good business. Transparent pricing builds trust and keeps merchants out of regulatory trouble.

In short, a merchant can’t just “turn on” surcharging on their own. It requires the right gateway or terminal configuration, BIN recognition, and reporting fields to ensure every transaction stays compliant. That’s why working with a reputable processor that can configure a Visa-compliant surcharge program is absolutely critical.

Why Many Businesses Surcharging

Outside of the few states that prohibit it, surcharging remains one of the most popular ways for businesses to offset card fees. It’s straightforward, compliant, and — when set up correctly — requires no updates to posted prices, invoices, or menus.

In most cases, it’s as simple as working with the right processor (like PayBright), ensuring the proper technology is in place, and following Visa’s published guidelines.

That simplicity is what makes surcharging so appealing. Merchants can quickly reduce the majority of their processing costs while keeping their advertised pricing consistent.

However, it’s not a perfect solution. Even with a compliant surcharge program, most businesses will still end up covering a small portion of their card-acceptance costs — which is where other strategies, like cash discounting and dual pricing, come into play. (See below.)

For detailed guidance:

2. Cash Discounting

Cash discounting is the opposite approach — it’s a non-fee-based program. Instead of adding a fee for card payments, the merchant gives a discount for cash.

The key rule: the posted or advertised price must always be the card price. The discount is then applied only when the customer pays with cash or another non-card method.

If a business advertises a lower “cash price” and adds a fee at checkout for cards, Visa considers it a surcharge — not a discount.

How It Works in Practice

To offset their processing costs, most merchants raise their standard, list, or marketed prices by roughly 4 %. Then, at checkout, they offer that same 4 % as a discount for cash-paying customers.

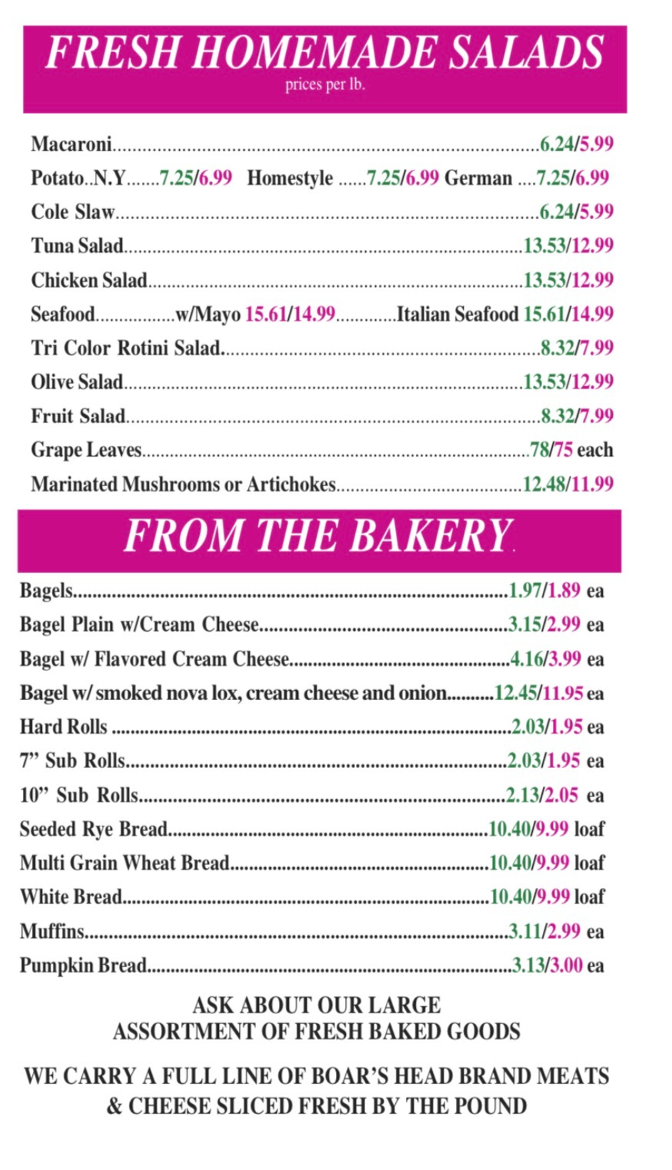

For example, an item that used to be $10 would now be listed at $10.40 on the menu or shelf. A customer paying with cash would receive a $0.40 discount, paying the original $10.

This structure keeps the advertised price compliant as the “card price,” while the cash discount is simply applied at the register.

Compliance & Experience

Cash discounting has no percentage cap and is legal in all 50 states. And unlike surcharging, Visa does not prescribe specific signage requirements.

A simple statement such as “We offer a 4 % discount for customers paying with cash” is typically sufficient to disclose the program.

Many business owners also find that cash discounting offers a better overall customer experience. Instead of adding a fee at checkout, the conversation becomes about offering savings for cash — not penalizing customers for using their cards.

Because of this, and because it can eliminate upwards of 100 % of processing costs, cash discounting has become one of the fastest-growing options among small businesses nationwide.

3. Dual Pricing

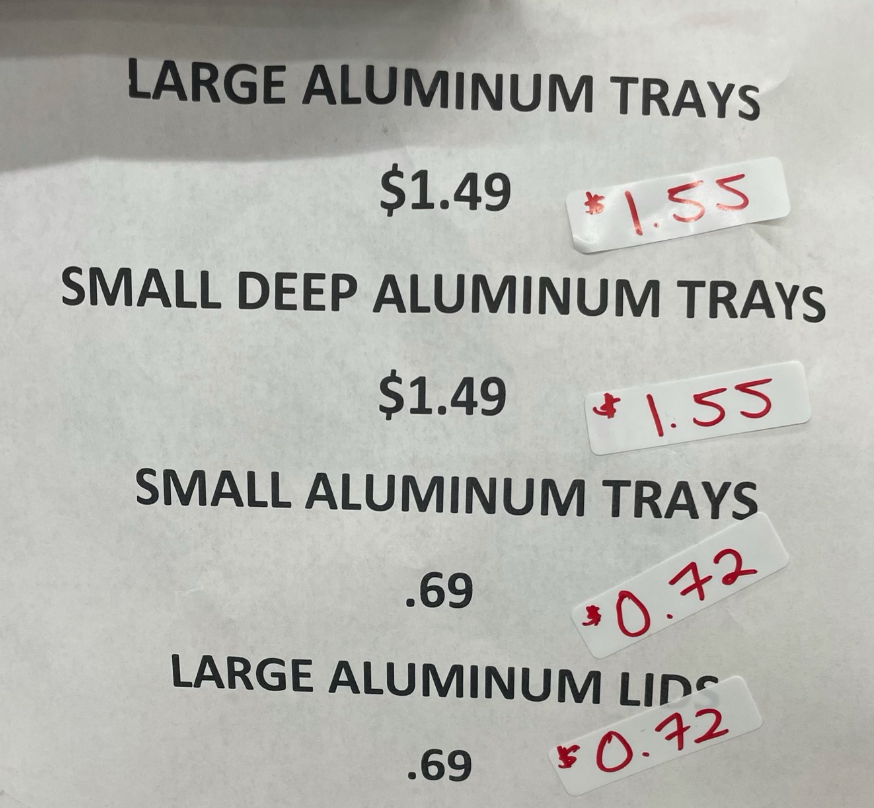

Dual pricing is essentially the visual form of a cash-discount program. Both the cash and card prices are displayed side by side everywhere pricing is shown — menus, shelves, websites, and digital displays.

Example:

$10 Cash / $10.40 Card

This is the most transparent form of differential pricing and the model Visa considers a “safe harbor” for compliance. As long as both prices are displayed upfront, and the system charges the advertised amount, the merchant is operating compliantly.

If a separate fee line appears on the receipt, it’s no longer dual pricing — it becomes a surcharge.

Dual pricing is legal in all 50 states, has no cap, and is widely supported on many modern POS Systems supported by PayBright. Modern dual pricing credit card processing systems make displaying both prices effortless.

Suggested signage example: “We offer both a cash price and a card price.”

Many merchants prefer dual pricing because, like cash discounting, it removes the “fee” conversation altogether. Instead, customers see both options and choose — making it feel more transparent and positive. Business owners also love that dual pricing often eliminates nearly 100 % of their processing costs while staying completely within Visa’s rules.

The Importance of Compliance

As these programs have grown, so has the need for strict compliance.

From 2018 through 2021, differential-pricing models — surcharging, cash discounting, and dual pricing — exploded in popularity for credit card processing/merchant services. Tens of thousands of small businesses began implementing these programs to offset or eliminate their credit card fees. For many, it wasn’t just about improving margins; it was about staying in business during a time of tight budgets and rising costs.

But as these programs spread, so did noncompliance. Some merchants — often unintentionally — launched versions of these programs that didn’t follow card-brand rules. Others were misled by processors or sales organizations that didn’t fully understand the compliance framework.

By 2023, Visa began taking these issues seriously. Throughout 2024 and into 2025, Visa has dramatically expanded its compliance enforcement around credit card processing compliance, deploying “secret shopper” audits and transaction-level monitoring to identify merchants operating outside the rules.

The penalties have been severe. According to Visa’s published enforcement framework, first-offense fines start at $1,000 — and there’s no “warning” phase. Repeat or egregious violations can escalate to $5,000, $25,000, or more, and processors or acquirers can face additional penalties if they knowingly support noncompliant programs.

For a small business, those fines can be devastating — often large enough to wipe out a month (or more) of profits. The most concerning part? Many merchants who get fined had no idea they were doing anything wrong.

That’s why compliance matters. Working with a processor that specializes in differential pricing — one that configures transactions correctly, monitors for compliance issues, and stays current on Visa and Mastercard updates — isn’t optional anymore. It’s the difference between running a profitable, sustainable program and risking everything on a technicality.

Universal Fee for all sales (Bonus)

A universal fee applies to all sales — cash and card alike. Because it’s not tied specifically to card use, it’s not considered a surcharge under Visa’s rules.

To stay compliant, it must apply uniformly to every transaction. If a merchant says, “We apply a 4 % fee to all sales but waive it for cash,” Visa would classify that as surcharging — and it would then be subject to the 3 % cap and credit-only limitation.

Visa also advises against naming it a “surcharge” or “card fee.” Neutral terms like Service Fee, Employee Satisfaction Fee, or Kitchen Support Fee are clearer and safer.

Universal fees are becoming more common as cash use drops below 5 % in many industries, simplifying compliance and pricing for merchants. In short, if a business wishes to add a fee, they can do so without violating card brand rules so long as it applies to all sales and payment methods equally. Note, businesses should be aware of potential state laws related to fees that may exist.

The Bottom Line

The cost of accepting cards isn’t going away — but the tools to offset that cost have evolved. These programs, when configured with Visa compliance rules in mind and supported by a reputable processor, allow merchants to reduce costs safely and transparently.

Surcharging helps businesses recover most of their processing costs, with minimal operational changes.

Cash discounting and dual pricing offer even greater savings and a more positive customer experience.

Universal fees are often an easier outlet for many small businesses and a valuable option in the right scenarios.

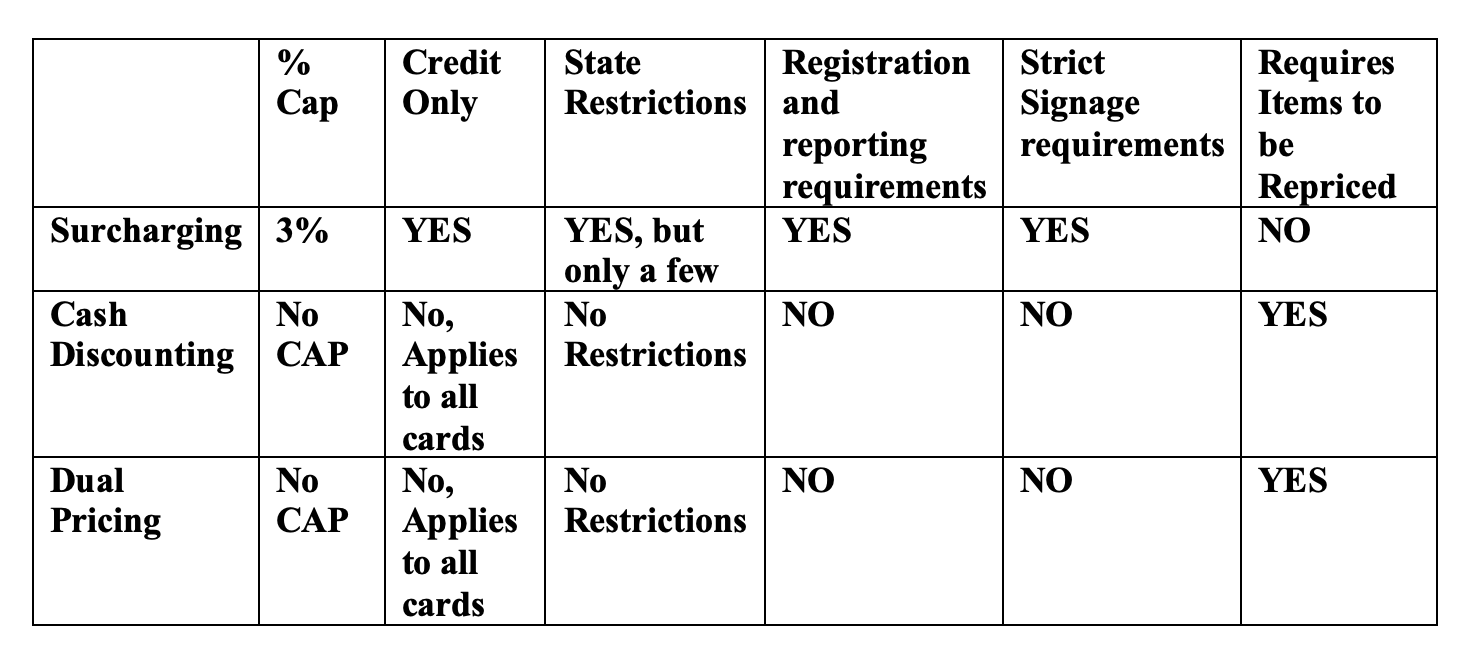

Surcharging vs Cash Discount vs Dual Pricing at a glance:

Here’s a quick comparison of the three most common differential pricing models:

Visa-compliant differential pricing comparison table – PayBright 2025

Not sure which model is right for your business? PayBright’s team can help you evaluate your options, build a compliant rollout plan, and handle your card-brand registration start to finish. Connect with us to get started.

At PayBright, we help merchants and agents with credit card processing compliance and navigate these programs the right way — ensuring they’re compliant, transparent, and profitable. Because when done correctly, differential pricing isn’t just about cutting costs — it’s about creating a smarter, more sustainable way to do business in an increasingly card-driven world.

Legal Disclaimer

The information in this article is provided for general informational purposes only and should not be relied upon as legal, financial, or compliance advice.

Rules, laws, and regulations regarding credit-card surcharging, cash discounting, dual pricing, and related differential-pricing programs vary by state and change frequently. Each state may have its own disclosure, signage, and pricing requirements, and Visa®, Mastercard®, American Express®, and Discover® each maintain separate compliance frameworks that are subject to periodic updates.

PayBright makes no representations or warranties as to the accuracy, completeness, or current status of any facts, figures, or interpretations presented. Information discussed here may become outdated or inaccurate based on subsequent rule changes, state legislation, or card-brand policy revisions.

Merchants and agents are strongly encouraged to:

Review current Visa and Mastercard documentation directly.

Consult with qualified legal counsel or compliance professionals familiar with applicable state laws.

Confirm program structures with their acquiring bank or processor before implementing any differential-pricing model.

This content reflects PayBright’s understanding of card-brand and regulatory guidance as of November 5, 2025 and is subject to change without notice.

Examples of compliant programs:

1. This is a compliant surcharge receipt. It is applied automatically by the PayBright terminal, but only on credit transactions. It is capped at 3%, and not greater than the merchant’s cost of acceptance.

2. This is an example of a compliant Cash Discount Receipt. The merchant’s listed price is the card pricing, and a discount offer is available for cash-paying customers. Note, to be compliant, the merchant’s menus/posted pricing needs to match the itemized prices on the receipt.

3. Dual Pricing menu outlining both a cash and card price. This is a menu that PayBright redesigned for a merchant in order to ensure their compliance.

4. An example of a DIY dual pricing model by a small business owner. Is it pretty? No. But is it compliant? Yes! The merchant clearly lists both the cash and card pricing.